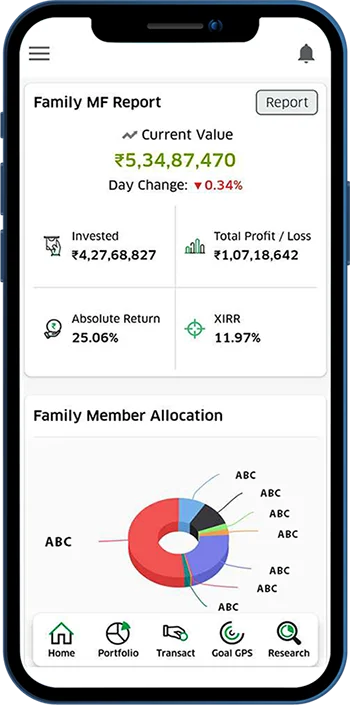

You can download the complete portfolio report including mutual funds & other assets. Get the historical performance of your portfolio easily & track the portfolio at your fingertips.

ABOUT US

Who We Are

Welcome to Samarth Capital , your trusted financial companion in India. We understand that your financial journey is more than just numbers; it's a story of dreams, aspirations, and the legacy you want to leave behind. At Samarth Capital, we are driven by the belief that everyone deserves a secure and prosperous future.

Our journey began with a simple promise: to empower every individual in India to achieve their financial goals and protect what matters most. We know that life's uncertainties can be overwhelming, but with the right guidance and support, you can navigate them successfully.

Our dedicated team of financial experts is committed to providing you with the best guidance and services tailored to your unique needs. We take pride in the relationships we've built with our clients, and their success stories inspire us every day.

In a rapidly changing world, we remain steadfast in our dedication to helping you secure your financial future. Your dreams are our top priority, and your trust is the cornerstone of our service.

Join us on this journey towards your financial freedom. Let's create a future that's not just financially sound but also peaceful. Together, we can turn dreams into reality.

SERVICES

What We Provide

- Wealth Management

- Tax Planning

- NRI Services in India

- FPI Services in India

- Drafting Will

Wealth Management

Wealth management is a holistic service that combines financial planning, investment management, and advisory services. With a focus on your individual financial objectives, wealth managers design personalized strategies that encompass all aspects of your financial life, from investment portfolios to tax and estate planning.

Types of Wealth Management:

Investment Management:

- Focuses on the creation and oversight of a diverse investment portfolio to maximize returns while minimizing risks.

Retirement Planning:

- Provides strategies to build and sustain your wealth post-retirement, ensuring you maintain your lifestyle after your working years.

Tax Planning:

- Helps optimize your tax liabilities through proper financial structuring, ensuring you maximize your wealth by paying the least amount of tax legally possible.

Estate Planning:

- Prepares for the efficient transfer of wealth to the next generation, minimizing tax burdens and legal hurdles.

Features of Wealth Management:

Personalized Approach:

- Every strategy is tailored to your financial goals, risk tolerance, and time horizon.

Holistic Service:

- It covers all aspects of your financial life, including investments, insurance, retirement, and estate planning.

Risk Management:

- Wealth management focuses on creating a balanced approach to managing risks associated with market fluctuations and life uncertainties.

Expert Advisory:

- Access to a team of experienced financial advisors who provide continuous support and guidance for informed decision-making.

Long-term Planning:

- Strategies designed for sustained wealth growth and protection over time, ensuring financial security across generations.

At Samarth Capital, our wealth management services are designed to help you grow and protect your financial assets. With a personalized approach that addresses all your financial needs, we provide you with the tools and expertise to achieve financial independence.

Tax Planning

Tax planning involves strategic financial moves aimed at reducing tax liabilities while maximizing savings within established financial regulations.

Objectives of Tax Planning:

- Tax Minimization: Decrease taxable income through lawful means.

- Savings Maximization: Utilize deductions for increased savings.

- Compliance Assurance: Adhere to financial laws while optimizing savings.

Strategies for Tax Planning:

- Section 80C Investments: Utilizing deductions under Section 80C for investments like PPF, ELSS, etc.

- Tax-Saving FDs: Investing in Tax-Saving Fixed Deposits under Section 80C for tax benefits.

- National Pension System (NPS): Availing tax benefits under Section 80CCD for contributions to NPS.

NRI Services in India

Basic Architecture

Non-Resident Indians can invest in following instruments in India:

- Equities: NRIs can invest in directly in Indian equities through Portfolio Investment Scheme (PIS) route provided by Reserve Bank of India. It is covered in detail later.

- Mutual Funds: Investment is allowed in all categories of Mutual Funds for NRIs like Equity, Balanced, Bond, Liquid Fund, etc. Unlike direct equities, investment in Mutual Funds does not require PIS permission from RBI. Lately, there have been some limitations for US and Canada based NRIs to invest in MFs as US government has mandated detailed reporting of transactions by Fund Houses under FATCA / CRS rules. Only few fund houses are accepting investments from US and Canada based investors.

- Government Securities: NRIs are allowed to invest in government securities on NRE or NRO basis. Interest on NRE investments is tax exempt while interest on NRO investments is taxable.

- Fixed Deposits: NRIs can invest in fixed deposit of Banks or Non-Banking Financial Companies (NBFCs) in case terms of the issue so provide. Investment can be done on NRE or NRO basis. Interest on NRO deposits is taxable and will be subject to withholding tax (TDS) while interest on NRE deposits is tax exempt.

- Real Estate: NRIs can buy residential and commercial properties in India. However, agricultural land, farm land or plantations are not allowed to be purchased - they can accept it in inheritance or gift.

- National Pension Scheme: NPS is government-backed retirement savings plan which comes under EET tax structure (Exempt-Exempt-Tax). It implies that all contributions and accrued capital gains are tax exempt, while withdrawal is subject to tax. This scheme is very cost effective. You can subscribe to this scheme if you have retained your Indian citizenship and plan to spend retired life in India. Contribution to NPS can be from NRE or NRO account, however the pension has to be received in India and cannot be repatriated.

Investment decision by an NRI is critical as the income will be taxed in multiple countries based on his/her tax residency. Here, we have enumerated tax treatment as per Indian laws. However, you will also have to consider the tax impact on this income in your home country of residence + Double Tax Avoidance Agreement (DTAA) between both these countries. Also, if your taxable income in India exceeds the basic exemption limit, then you will have to file tax returns in India and pay balance taxes / claim refund as the case may be. We have covered taxation in detail little later.

Type of Accounts

NRI Investments

| Non Resident External (NRE) | Non Resident Ordinary (NRO) | FCNR |

|---|---|---|

| Permitted Investments > Equity Shares > Mutual Funds > Bank Fixed Deposits |

Permitted Investments > Equity Shares > Mutual Funds > Bank Fixed Deposits |

Investments permitted in Fixed Deposits Only |

| Investment can be done from > Overseas funds remitted in India > Existing funds in NRE account Investments permitted in INR only |

Investment can be done from > Overseas funds remitted in India > Existing funds in NRO account > Funds from NRE account Investments permitted in INR only |

Interest rates are fixed |

| On sale, full proceeds can be freely repatriated outside India | On sale, proceeds are repatriable subject to: > Limit of USD 1 mn per year or equivalent, year is from April to March > Certificate required from Chartered Accountant in Form 15CA & 15CB |

Redemption proceeds can be freely repatriated outside India |

Refer to Tax Section for tax treatment on all the investments mentioned above

Portfolio Investment Scheme (PIS)

PIS is a permission from Reserve Bank of India (RBI) to NRIs for dealing in shares and convertible debentures. Practically, it is in the form a special bank account which is used for routing secondary market (broker) transactions. All transactions relating to purchase and sale of shares and convertible debentures of Indian companies on a recognized stock exchange should be routed through this account with a designated bank.

There is overall limit beyond which an NRI is not allowed to invest in equity share of each company. Through this account, RBI keeps a check on overall NRI holding in each company. When the limit approaches nearer, the company is placed under caution list and further buying is allowed only after the prior permission of RBI. Once the limit is breached, no further buying is allowed. If any purchase is made beyond limits, then such excess holding will have to be liquidated immediately.

The caution list of RBI can be accessed from following link:

https://www.rbi.org.in/advt/fiinri.html

Transaction Flow for Investing in Equity Shares

Transaction Flow for Investing in Equity Shares

- You can give order through phone call, email, or messenger.

- Alternatively, you can use Web Portal or Mobile App to execute orders (except USA & Canadian Clients).

- Once orders are executed, you will get confirmation from your dealer through phone/email/messenger or on the screen (in case of online).

- You will receive the Contract Note on email by day-end.

- Every contract note is to be submitted to the Bank where you have a PIS account in 24 hours for reporting it to the Reserve Bank of India.

- As a part of the service, we do this submission on your behalf.

- Once the trade is reported, funds will be transferred by the bank from the PIS account to us on T+1 day.

- On receipt of money from the bank, we will transfer shares to your demat account.

- Once the trade is reported, shares will be transferred from your demat to the stock exchange by us on T+1 day. Money will be sent to the bank by day-end.

- The bank usually takes one day for calculating capital gains tax & transfers net proceeds to your PIS account.

What we can do for you

We will:

- Engage bankers to open NRE / NRO savings and PIS bank accounts

- Open a brokerage account for execution of trades

- Open a demat account

- Regularly monitor your Portfolio

- Appoint tax consultant to take care of compliance

Our Partner for Banking Services:

.png)

.png)

Our Partner for Broking Services:

.png)

Documentation

To start with investment account, you need to open:

- NRE / NRO savings account with a bank in India

- NRE / NRO PIS account with a bank in India

- Demat account

- Brokerage account

Documents required:

- PAN Card

- Passport

- Visa - in case of Indian Passport

- Permanent Identity - in case of Foreign Passport

- Overseas Address Proof

- Drivers License

- Utility Bill

- Overseas Bank Statement

- Indian Address Proof (Mandatory for NRO account only)

All the copies need to be self-attested

For FATF non-compliant countries, all the above documents are to be attested by Notary Public. You can get list of FATF compliant countries in following

FPI Services in India

Basic Architecture

Who can be an FPI ?

- Foreign Portfolio Investor (FPI) is a resident individual or entity in any country other than India. FPI is not a Non-Resident Indian (NRI) / Overseas Citizen of India (OCI) or a Resident Indian (RI).

- If the investor entity is non-individual, NRI / OCI / RI may be constituents if:

- RI (being non-individual) is an eligible fund manager and

- The entity is an eligible investment fund.

- The entity is an Alternative Investment Fund (AIF) set up in the International Financial Services Centre (IFSC).

- RI is a sponsor or manager of the entity

- Contribution of RI shall be:

- In case of Category I or II AIF, lower of 2.5% of the corpus or US$ 0.75 million

- In case of Category III AIF, lower of 5% of the corpus or US$ 1.5 million

- c. Investor is from a Country which:

- is a member of IOSCO

- have bilateral MOU with SEBI

- whose central bank is a member of BIS

- is not in the sanction list notified by UNSC and

- is not listed in public statement issued by FATF

- Investor has sufficient experience, good track record, is professionally competent, financially sound, generally good reputation of fairness and integrity

Classification

There are two categories of FPIs, classified as under:

Category I

- Government and Government related investors such as central banks, sovereign wealth funds, international or multilateral organizations or agencies, including entities controlled, or at least 75%, directly or indirectly, owned by such Government and Government related investors.

- Pension funds and university funds.

- Appropriately regulated entities such as insurance or reinsurance entities, banks, asset management companies, investment managers, investment advisors, portfolio managers, broker dealers and swap dealers.

- Entities from the Financial Action Task Force (FATF) member countries which are:

- Appropriately regulated funds.

- Unregulated funds whose investment manager is appropriately regulated and registered as a Category I FPI - provided that the investment manager undertakes the responsibility of all the acts of commission or omission of such unregulated fund.

- University related endowments of such universities that have been in existence for more than five years.

- An entity:

Whose investment manager is from FATF member country and such an investment manager is registered as Category I FPI; or Which is at least 75% owned, directly or indirectly by another entity, eligible under sub-clause (b), (c) and (d) above, and such an eligible entity is from a FATF member country.

Category II

Includes all the investors not eligible under Category-I Foreign Portfolio Investor such as

- Appropriately regulated funds not eligible as Category-I foreign portfolio investor

- Endowments and foundations

- Charitable organisations

- Corporate bodies

- Family offices

- Individuals

- Appropriately regulated entities investing on behalf of their client, as per conditions specified by the Board from time to time

- Unregulated funds in the form of limited partnership and trusts

Omnibus Accounts

Appropriately regulated entities such as banks and merchant banks, asset management companies, investment managers, investment advisors, portfolio managers, insurance & reinsurance entities, broker dealers and swap dealers will be permitted to undertake investments on behalf of their clients as Category II FPIs in addition to undertaking proprietary investment by taking separate registrations as Category I FPI.

- Where such entities are undertaking investments on behalf of their clients, Category II FPI registration shall be granted subject to following conditions: Clients of FPI can only be individuals and family offices.

- Clients of FPI should also be eligible for registration as FPI and should not be dealing on behalf of third party.

- If the FPI is from a Financial Action Task Force member country, then the KYC including identification & verification of beneficial owner of the clients of such FPI should be done by the FPI as per requirements of the home jurisdiction of the FPI. FPIs from non-Financial Action Task Force member countries should perform KYC of their clients including identification & verification of beneficial owner as per Indian KYC requirements.

- FPI has to provide complete investor details of its clients (if any) on quarterly basis (end of calendar quarter) by end of the following month to DDP.

- Investments made by each such client, either directly as FPI and/or through its investor group shall be clubbed with the investments made by such clients (holding more than 50% in the FPI) through the above referenced appropriately regulated FPIs.

Asset Class for Investments

- Shares, Debentures and Warrants issued by a listed company or to be listed company

- Units of Mutual Funds - Equity and Bond Schemes

- Units of Collective Investment Schemes

- Derivatives

- Units of Real Estate Investment Trusts, Infrastructure Investment Trusts and Units of Category III AIF

- Indian Depository Receipts

- Debt Securities

In case of secondary market transactions:

- The securities transactions can be delivery-based only

- The dealing will be through registered stock broker only

- Securities should be in dematerialised form

- The equity shareholding by a single FPI, including its investor group, shall be below 10% of paid up equity capital of the investee company.

Offshore Derivative Instruments

Offshore derivative instruments can be issued if:

- The issuer is Category I FPI

- The instruments are issued to persons eligible for registration as Category I FPI

- Know Your Client norms are complied with

- In case of transfer, the above conditions should be met

Procedure to Open the Account

Appoint a Stock-Broker / Custodian who will assist you in:

- Applying for Unique Income Tax Code (called as PAN in India)

- Opening Rupee based bank account

- Opening a Demat account for custody of your securities

- Open a brokerage account for transacting

In about 3 to 4 weeks from the date of receipt of all the documents duly signed, the FPI will be able to bring in money & start investing.

Procedure to Process the Transaction

- The FPI can place buy / sell orders directly with the stock-broker OR route it through their Order Management System which may be provided by Custodian. The FPI can access the status of their orders & execution status through an online browser-based system application.

- Post Execution of trades, the settlement of securities as well as funds will be done by Custodian without any action needed from FPIs end.

- Custodian will deduct withholding tax and pay to the Government, wherever applicable, on each sale transaction during investment activity in India.

- Investments by FPIs are governed by overall limits which varies in case of each company and each asset class. Monitoring of such limits will be done by the Custodian.

- The Funds invested through this route are fully repatriable at any point of time.

- The tax returns in India can be managed by FPI appointed consultants. Alternatively, we can assist in appointing the tax consultants.

What we can do for you?

We will:

- Engage a Custodian for you to take care of documentation and custody of assets

- Engage a bankers to open and maintain Rupee denominated bank accounts

- Open a brokerage account for execution of trades

- Regularly monitor your Portfolio

- Engage a tax consultant to take care of compliance

Our Partner for Custody Services:

Our Partner for Broking Services:

For Regulatory Content: Visit www.sebi.gov.in

Drafting Will

We make nomination for all the assets however, nominee doesn't become owner of the assets, they are mere trustees.

Initially, nominee gets the transfer of the asset in her name but eventually, is bound to transfer the assets in favour of the legal heirs. The nomination must be ratified by a Will.

Will is a document that expresses how your property is to be distributed upon death. A Will that clearly lays out your wish reduces conflict and speculation over what you "would have" wanted.

Normally, we thinkthat we are not going to die so earlyor we have a habit of deferring actions which are common reasons for not having a Will. The realization that Will isnecessary comes too late - such as when an unexpected death or disability occurs. To avoid the added stress on families during an already emotional time, it may be wise to prepare Will before-hand and revise it at regular intervals.

Having a Will is very important since through this document you decide:

- how your property and assets will be distributed.

- who will take care of your minor children

- who will wind up the affairs of your estate

- you can disinherit individuals who would otherwise stand to inherit

- make gifts and donations from your property

In the absence of Will, the law will decide how your assets will be distributed. And in that case, the process becomes lengthy and, in most cases, give rise to family conflicts.

In India, there are four succession laws applicable depending on the religion you follow:

- Hindu Succession Act - Hindus, Sikhs, Jains and Buddhist

- Muslim Personal Law (Shariat) Application Act - Muslims

- Special Marriage Act - Inter faith marriages

- Indian Succession Act - Parsi, Christian, Jews and Others

You can prepare a Will yourself. No legal services are required to prepare a Will.

Simple steps to write a Will:

- Select beneficiaries to your assets / property

- Pick a guardian for your kids

- Choose the executor for your will

- List down who gets what

- Realistically assess the distribution of assets done

- How to write a Will:

- You can write Will on simple paper

- Write down the distribution of assets amongst beneficiaries as detailed above

- Put your signature on the Will

- Two external witnesses should be present while preparing the Will who will also put their signature

- A doctor certificate must be attached testifying sound health and sound mental condition

- Notarising the Will is not required

- Registration of the Will is not compulsory but is recommended

- Store your Will where others can find it. Don't keep your original Will in a bank locker. Make sure that the executor knows about the Will.

Format of Will

FEATURES

Financial Tools

Features

Get Started With Samarth Capital Markets Pvt Ltd

-

Portfolio Analysis

-

Invest Online

We offer a 100% paperless process of investment. It takes a few seconds to register a SIP or Purchase an ELSS.

-

Goal Tracker

Give purpose to your investments, you can map all your investments with the goal like child education, marriage or retirement.

-

Research

Invest in well researched cherry-picked perfectly balanced portfolio.

sip

Power Of SIP

Testimonials

What People Say

I am associated with Samarth Capital since more than a decade and very glad to share that they have been trustworthy and reliable in recommending quality stocks and carrying out the transactions smoothly and accurately.

They have been on the forefront of recommending good quality research and also educate me design a strategic portfolio which helped in meeting my future financial needs. Systematic financial planning and management of funds have not just improved the way I manage funds, but also helped me in taking the right risks in a structured manner.

Kekin Nandu

Director, Richa Housing Projects Pvt LtdSamarth Capital has a differentiated approach to value investing. Where else can you have ready advisory on insurance, bonds, equity. Perfect for retail and SMB. Their model portfolio has always been way above the market average. Highly recommended as trusted and reliable financial advisors!!

Vivek Gupta

Director, BigSwitch Ventures Pvt LtdThank you Samarth Capital and Team for your help with my investment portfolio. I have contacted them a year ago for re-evaluating my current investments and provide with the solution which will secure our future. After analyzing my current portfolio, they recommended couple of customized plans (Insurance + MF SIP and refurbishing of my existing Portfolio) to cover our retirement corpus. They are very professional in terms of providing service and keeping track of all the investments. Everything is communicated in a professional and timely manner. I am rest assured that my investments are going to yield good results in the long term. I am very satisfied with the service provided by Samarth Capital team. I wish them the very best for future endeavors.

Saurabh Gandhi

DGM Finance, Ajmera Realty & Infra India LtdGreat service and guidance store to create your wealth. The bond and relation that grows with time along with your networth growth.

Kuldeep Sheth

Zone Head - Digit Life InsuranceI am impressed with how promptly you act on issues facing and force others to follow. This is the American way ! My hat's off for you.

Dr Sudheendra Rao, USA

Tata Motors ADR conversion to Sharesteam

Our Consulting Team

Arvind Mistry

Co-founder & Director

Abhishek Mistry

Co-founder & Director

Anuj Dixit

Senior Investment Manager

Yagnesh Patel

Senior Technical Analyst

Mitesh Gada

Fundamental Analyst

Manthan Desai

Corporate Legal Advisor

faq

Frequently Ask Questions

- Wealth Management

- Tax Planning

- NRI Services in India

- FPI Services in India

- Drafting Will

What is Wealth Management?

Wealth Management is a comprehensive service that helps individuals manage and grow their financial assets. It includes investment advisory, financial planning, tax optimization, retirement planning, estate management, and more, aiming to achieve financial goals.

Who can benefit from Wealth Management services?

Wealth management services are typically beneficial for individuals with a high net worth or complex financial needs. However, anyone looking to secure their financial future, plan for retirement, or grow their wealth can benefit from personalized wealth management services.

How do wealth managers create a financial plan for me?

Wealth managers assess your current financial situation, understand your long-term goals, and develop a personalized strategy to meet those goals. This includes managing investments, minimizing tax liabilities, and ensuring proper estate planning.

What types of investments are recommended in Wealth Management?

Wealth managers offer a variety of investment options, including stocks, bonds, mutual funds, real estate, alternative investments, and more. The choice of investments depends on your risk tolerance, time horizon, and financial goals.

What is Tax Planning?

Tax planning is the process of analyzing your financial situation to minimize tax liabilities legally. It involves using available tax-saving instruments, deductions, and exemptions to optimize your tax outflow while aligning with your financial goals

Why is Tax Planning important?

Tax planning helps you:

- Reduce your taxable income and save money.

- Ensure compliance with tax regulations, avoiding penalties.

- Align your investments and financial decisions with long-term goals.

- Improve cash flow management by optimizing tax payments.

What are the common tools used in Tax Planning?

Tax-saving tools include:

- Investments under Section 80C (e.g., ELSS, PPF, Life Insurance).

- Deductions for health insurance premiums under Section 80D.

- Tax benefits on home loans under Sections 24(b) and 80EE.

- Contributions to the National Pension System (NPS).

- Exemptions like HRA and Leave Travel Allowance (LTA).

Can Tax Planning help with long-term wealth creation?

Yes, tax planning supports wealth creation by encouraging disciplined investments in tax-saving instruments that also offer growth potential. For example, Equity-Linked Savings Schemes (ELSS) combine tax benefits with equity market returns, and contributions to NPS build a retirement corpus.

What are NRI Services in India?

NRI (Non-Resident Indian) Services refer to specialized financial, investment, and legal solutions designed to cater to the unique needs of Indians living abroad. These services include assistance with bank accounts, tax planning, investments, property management, repatriation of funds, and compliance with Indian regulations.

What types of bank accounts can NRIs open in India?

NRIs can open the following types of accounts in India:

- NRE (Non-Resident External) Account: Allows income earned abroad to be deposited in India in Indian Rupees. The principal and interest are fully repatriable.

- NRO (Non-Resident Ordinary) Account: Used for managing income earned in India, such as rent or dividends. Repatriation is subject to limits.

- FCNR (Foreign Currency Non-Resident) Account: Maintained in foreign currency, protecting against exchange rate fluctuations.

Can NRIs invest in Indian financial products?

Yes, NRIs can invest in various financial products, including:

- Mutual Funds through NRE or NRO accounts.

- Equity and Stock Markets under the Portfolio Investment Scheme (PIS).

- Real Estate, such as residential or commercial properties.

- Fixed Deposits in NRE/NRO/FCNR accounts.

- Government bonds and National Pension System (NPS).

What are the tax implications for NRIs in India?

NRIs are taxed only on income earned or accrued in India. Common taxable sources include:

- Rental income from properties.

- Capital gains from the sale of assets.

- Interest earned on NRO accounts.

Certain incomes, like interest on NRE and FCNR accounts, are tax-exempt in specific cases.

What is an FPI (Foreign Portfolio Investor)?

An FPI is an investor or investment fund registered outside India that invests in Indian financial markets, such as equities, bonds, or other securities. FPIs typically aim to benefit from India’s economic growth and market potential while adhering to regulatory guidelines set by the Securities and Exchange Board of India (SEBI).

How can foreign investors register as FPIs in India?

To register as an FPI in India, foreign investors must:

- Apply through a Designated Depository Participant (DDP) approved by SEBI.

- Fulfill eligibility criteria, such as domicile, net worth requirements, and fit-and-proper norms.

- Provide necessary documents, including identity proofs, declarations, and compliance with anti-money laundering (AML) regulations.

What investment options are available for FPIs in India?

FPIs can invest in:

- Equities: Listed shares, equity derivatives, and initial public offerings (IPOs).

- Debt Instruments: Government securities, corporate bonds, and infrastructure debt funds.

- Mutual Funds: Units of domestic mutual funds in equities or debt schemes.

- Alternative Investment Funds (AIFs): Participation in private equity or venture capital funds.

What are the tax implications for FPIs in India?

FPIs are subject to tax on income earned in India, which includes:

- Capital Gains: Taxed differently based on the type and duration of investment (e.g., short-term or long-term capital gains on equities and debt).

- Interest Income: Taxable on debt instruments, often at concessional rates under Double Taxation Avoidance Agreements (DTAAs).

- Dividends: Taxed at a flat rate, with the possibility of DTAA relief.

- FPIs must comply with Indian tax regulations, and professional advisory services are often required to navigate complexities.

What is a Will, and why is it important?

A Will is a legal document that specifies how an individual’s assets and estate will be distributed after their demise. It is important because:

- It ensures that your assets are distributed as per your wishes.

- It minimizes disputes among heirs and beneficiaries.

- It simplifies the legal process for your family and ensures smooth estate transfer.

What are the essential elements of a valid Will?

To be legally valid, a Will must:

- Be written and signed by the person creating it (the testator).

- Include details of the assets and their intended beneficiaries.

- Be signed in the presence of at least two witnesses, who must also sign the Will.

- Clearly mention the date and the name of an executor (optional but recommended).

Can a Will be changed or revoked?

Yes, a Will can be changed or revoked at any time during the testator's lifetime. This can be done by:

- Drafting a new Will that explicitly states the revocation of previous Wills.

- Adding a Codicil, which is a legal document to amend specific parts of an existing Will.

- Revocation is also automatic if the testator destroys the original Will with the intention to revoke it.

Do I need a lawyer to draft a Will?

While a lawyer is not mandatory to draft a Will, professional assistance ensures:

- The Will complies with legal requirements and avoids future disputes.

- The document is free of ambiguities and clearly communicates your intentions.

- Proper advice is provided on complex matters such as estate taxes, asset division, or appointing guardians for minors.

Contact Us

+919820331713

Phone Numbercustomercare@samarthcapital.in

Our MailSend A Message

Our Partners

Top AMC's With Us

Kekin Nandu

Director, Richa Housing Projects Pvt Ltd

I am associated with Samarth Capital since more than a decade and very glad to share that they have been trustworthy and reliable in recommending quality stocks and carrying out the transactions smoothly and accurately.

They have been on the forefront of recommending good quality research and also educate me design a strategic portfolio which helped in meeting my future financial needs. Systematic financial planning and management of funds have not just improved the way I manage funds, but also helped me in taking the right risks in a structured manner.

Vivek Gupta

Director, BigSwitch Ventures Pvt Ltd

Samarth Capital has a differentiated approach to value investing. Where else can you have ready advisory on insurance, bonds, equity. Perfect for retail and SMB. Their model portfolio has always been way above the market average. Highly recommended as trusted and reliable financial advisors!!

Saurabh Gandhi

DGM Finance, Ajmera Realty & Infra India Ltd

Thank you Samarth Capital and Team for your help with my investment portfolio. I have contacted them a year ago for re-evaluating my current investments and provide with the solution which will secure our future. After analyzing my current portfolio, they recommended couple of customized plans (Insurance + MF SIP and refurbishing of my existing Portfolio) to cover our retirement corpus. They are very professional in terms of providing service and keeping track of all the investments. Everything is communicated in a professional and timely manner. I am rest assured that my investments are going to yield good results in the long term. I am very satisfied with the service provided by Samarth Capital team. I wish them the very best for future endeavors.

Kuldeep Sheth

Zone Head - Digit Life Insurance

Great service and guidance store to create your wealth. The bond and relation that grows with time along with your networth growth.

Dr Sudheendra Rao, USA

Tata Motors ADR conversion to Shares

I am impressed with how promptly you act on issues facing and force others to follow. This is the American way ! My hat's off for you.