Our Approach

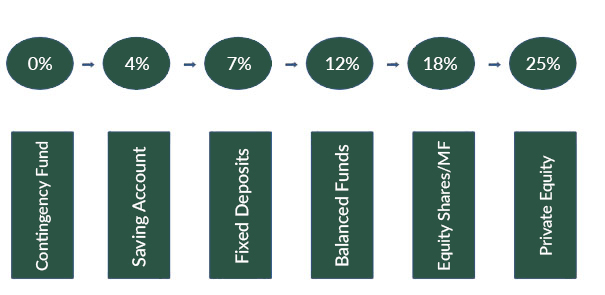

You cannot start graduation studies from day 1 of your life, you have to undergo pre-primary, primary, secondary and then graduation course. Similarly, wealth building is a systematic exercise that has to be built in phases. We use 0 to 25 progress scale for an investor. This denotes percentage return on your investment and shows how far you have progressed in your financial life.

1st Phase (0%): where you have to maintain mandatory cash in your kitty which would generate zero return but it is necessary to keep it to ensure your daily needs.

2nd Phase (4%): indicates amount of balance you have to maintain in your savings bank account for unexpected contingencies like medical emergency, etc.. Typically, it has to be three months of your household expenditure plus loan EMIs. You can either keep this funds in savings bank account or fixed deposits of shorter duration or money market funds which can be callable at one day's notice. This kitty ensures that your medium and long term investments are not disturbed when an unforeseen financial emergency attacks your family.

3rd Phase (7%): indicates amount you have to park in fixed-income instruments including bank fixed deposits for longer duration, corporate deposits, debentures, bonds, etc. The amount to be parked in fixed income instruments will be determined by your risk-return profile. Taking a broader view, you can use thumb rule of (100 - your age) to be parked in equity and balance in fixed-income.

4th Phase (12%): after having passed through above three phases, then we can proceed to invest in variable-income instruments which are for a longer duration. If you are risk averse then, you can look at hybrid instruments which invests partially in equity and bonds. If your risk-return profile favours taking more risk, then you can skip this stage.

5th Phase (18%): here, we can start investments directly in listed equity or through investment vehicles like mutual funds or portfolio investment schemes. Necessarily this investment has to be for longer duration (at-least 5 years) to benefit optimally.

6th Phase (25%): this is the phase where you can afford to take more risk for getting extra honey pie. You become a matured investor with ability to understand the underlying risk associated with structured products. You can invest in unlisted equity through vehicles such as alternate investment funds. These funds have low liquidity and high risk but rewards are equally commensurate.